Introduction

Central Bank Digital Currencies (CBDCs) mean different things to different groups of people. From a politician’s or regulator’s standpoint, a CBDC could mean a centralized digital dollar they can control with a direct line between the government and the consumer.

When you think about it this way, it doesn’t sound so great…will the same government that enforces laws and taxes ultimately have access to our “Fed” account?

The Fed recently published a press release outlining their pilot program for FedNow, a national digital payments solution that could lay the groundwork for a US CBDC.

But what’s the big deal? We hardly ever use cash anyways, so why not just go fully digital with our dollars and roll out the CBDC?

Before you decide whether to jump on the CBDC bandwagon or reaffirm your allegiance to Bitcoin, let’s review some of the key differences between a CBDC and Bitcoin (and there are many differences!). Let’s start with 2 basic definitions:

What is a CBDC?

A Central Bank Digital Currency (CBDC) is a digital form of money that is issued from and controlled by a nation’s central bank.

A CBDC might look and feel very much like fiat, only with faster reconciliation and potential cost savings for banks or intermediaries.

CBDCs could potentially provide a direct line between your government and your complete financial existence.

Prototypes to this day do not generally use blockchain technology. If they do, it may be a Consortium Blockchain, which is permissioned and centrally controlled.

The maximum supply of a CBDC is much like fiat: infinite.

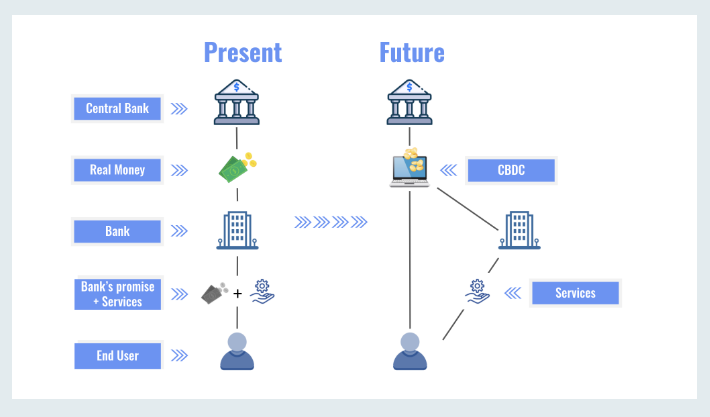

As you can see from this handy diagram, the US government is now toying with the idea that money doesn’t have to come from an employer, but can come directly from the Fed in the form of a CBDC:

Image source: DigitalAsset.com

What is Bitcoin?

Bitcoin is a digital currency that allows for Peer-to-Peer transactions from any device to another, across borders, without the need for 3rd party banks or payment processors.

The system is based on a decentralized blockchain ledger that is open and transparent, yet shields the user’s identity.

This ledger connects every transaction ever made through cryptographic hashing, making it near impossible and financially dubious to try and alter a transaction - you have to change every transaction (currently up to 817 million).

The maximum supply of Bitcoin can only be 21 million.

Bitcoin isn’t centrally controlled but is run and maintained by thousands of specialized hardware devices that maintain the payments network using incentivization and game theory.

Image source: YCharts.com

[CBDC transactions are not noted above, because live CBDCs only exist in a few Caribbean Islands and Nigeria and trackers are not yet available.]

Key Differences Between a CBDC and Bitcoin

#1 - Centralized vs. Decentralized

CBDCs will be ruled from their center, your government and/or central bank. In the case of the US, the Federal Reserve, a non-electable entity, will regulate the course of the CBDC. A CBDC in the US could make the US Dollar even more centralized, as intermediaries could decrease.

Bitcoin is decentralized, meaning anyone can run a live copy of the Bitcoin Network using hardware and software. With thousands of computers (“nodes”) across the globe maintaining a live version of the ledger, this money system becomes incredibly hard to attack, owing its security in part to the system of decentralization.

#2 - Non-transparent vs transparent

As with our current banking system, A CBDC’s transparency will likely be completely one-sided. While the Fed, banks, credit reporting agencies, tax agencies, and lending outlets have a wide lens to view your money history and activities - you don’t have the same level of insight into the inner workings of these entities.

With Bitcoin, the way it works is clearly spelled out in the Bitcoin whitepaper, published in 2009 by the pseudonymous Satoshi Nakamoto. Beyond that, every Bitcoin transaction is posted live for public view on the Blockchain ledger. You can view any number of Blockchain Explorers to see the activity of the Bitcoin ledger. Additionally, Bitcoin development is open source, meaning if Bitcoin were to shut down today, the code to restart it is publicly available.

Image source: Bitcoin.org

#3 Money Supply

In a day and age where “inflation” is on everybody’s minds, a CBDC does not do much to quell our worries about inflating the USD. The Fed has openly admitted that they already have an infinite ability to print digital dollars. This “soft-money” system will be no different from a CBDC.

Image source: TradingEconomics.com

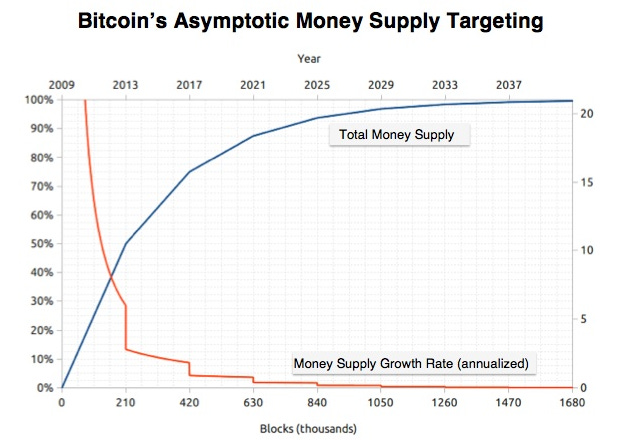

There will only ever be 21 million bitcoins and these are “minted” by miners (those running the Bitcoin software and processing transactions) over a set period of time ending sometime around 2140. This “hard money” system provides a store of value (like digital gold).

Image source: NakamotoInstitutue.org

#4 Surveilled vs. Anonymous

The number of ways in which we use physical dollars grows smaller every year. At the same time we are losing our right to use our money without a million intermediaries gathering out data and charging processing or transaction fees.

A CBDC prepares its citizens for the elimination of cash, potentially giving the government a complete view of and control over every (digital) dollar spent.

Bitcoin enables you to transact without giving up your name or any personal information. While transaction details such as hash, date, public address, and amount are viewable on the Blockchain Explorer in real-time, your name, address, and other personal details are left out.

There are ways to track the activities of public blockchain addresses, but there are also tools out there that help the Bitcoiner optimize their financial privacy.

#5 Low Volatility vs. High Volatility

We have no real way of knowing how a CBDC will perform in global markets because there’s been no performance thus far; but it will likely depend on the central banks that issue it:

Are they large economies like China and the US where it’s more difficult to tilt markets because of their sheer size?

Will CBDCs from emerging countries like India and Brazil be more volatile?

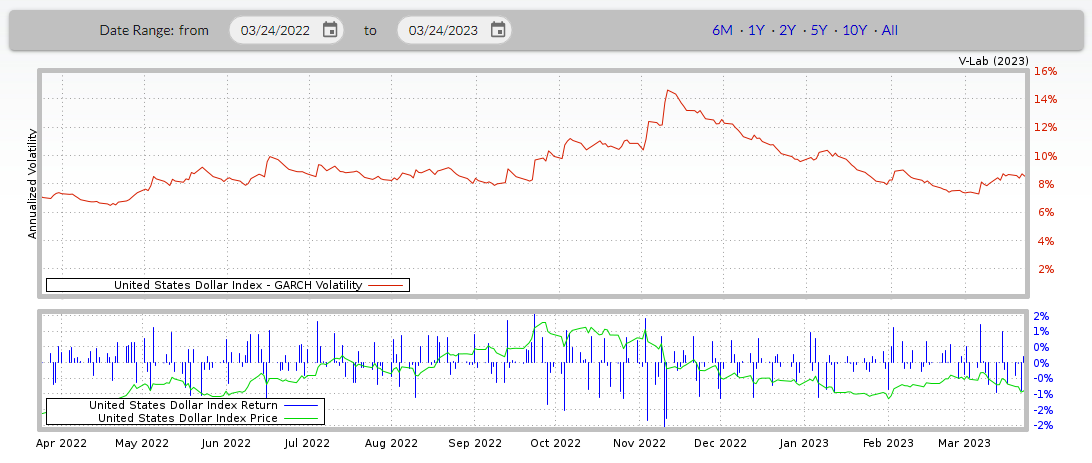

In the US, we may assume that since the CBDC will largely be run by the same organizations that gave us fiat, the volatility will remain low as long as there is one strong CBDC. In a CBDC multiverse, it’s hard to know how it will play out.

USD volatility over 1 year - Image source: V-Lab

Bitcoin, on the other hand, is admittedly volatile. The relatively small number of participants as well as market trends and news can move the price needle more easily. We have never seen a major currency like USD lose half its value in a week, but with Bitcoin, that can happen.

For long-term hodlers who see Bitcoin as a store of value, volatility is not a problem. For traders who profit from price swings, it’s not a problem. But for people who want to use it as day-to-day cash, it’s a problem. Influencers like to say that Bitcoin’s volatility gets lower over time, and the data backs them up. Layer-2 protocols like the Lightning Network are laying the groundwork to increase the number of Bitcoin transactions that can be processed.

Bitcoin volatility over 1 year - Image source: The Block

I hope you enjoyed this review of some of the main differences between CBDCs and Bitcoin.

Stay tuned for next week’s Part II to learn more about how Bitcoin compares with the digital currencies being developed as part of the imminent rise of CBDCs.

Great article